Send Money Instantly Using Mobile Numbers, Email Addresses, or QR Codes with Aani

Aani is now available on NBQ Mobile Banking App, powered by Al Etihad Payments (AEP), a subsidiary of the Central Bank of the UAE (CBUAE).

With Aani, you can send or request money using mobile numbers, email addresses, or QR codes.

This allows you to carry out transactions without sharing your bank account details with individuals who are already enrolled in Aani App.

Features

- Instant payments: Send money to family or friends in seconds.

- Request money: Easily request money from your contacts using their mobile numbers or email addresses.

- Split bill: Conveniently split a bill with others by simply showing a QR code or by sending a request to your contacts.

- QR code payments: Pay quickly and easily by scanning QR codes with your mobile phone.

- Manage requests: Easily accept, decline or cancel new requests in the App.

Benefits

- Free - Transfer money at zero cost.

- Security - Aani is a safe way to move money, enabling secure transfers for individuals, merchants, and corporates.

- Ease of transfer - Use mobile numbers, QR codes, or other easy ways to send money without the need to share bank account numbers or IBANs.

- 24/7 Transaction Processing - Aani processes transactions in a matter of seconds, anytime, any day.

- Speed and Convenience - Aani is the fastest way to pay, enabling you to complete transactions in seconds.

- Aani is based on the highest security standards and is licensed by the Central Bank of the UAE.

- Always remember to check the sender of the request to pay before accepting it.

- NBQ does not accept any responsibility or liability for enabling you to use Aani App.

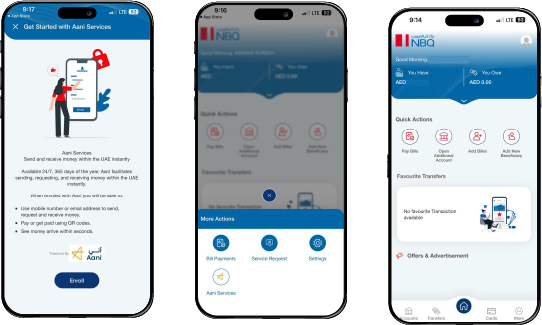

How to Access Aani Services on NBQ Mobile Banking:

- Login to NBQ App and select Aani under "More" located at the bottom of your NBQ App home screen *.

- Select "Aani" and follow the steps to enroll Aani service.

- Download the Aani App and register with your mobile number.

- Select NBQ as your primary account to send and receive money.

* Update NBQ Mobile Banking App from Apple/ Samsung store.

Frequently Asked Questions

- What is Aani Instant Payments Platform?

-

Aani Instant Payments Platform is an initiative of the Central Bank of the UAE (UAE Instant Payments Platforms, UAEIPP) under the National Payments Systems Strategy (NPSS) to provide instant 24/7 local transfers.

- What are the features of Aani?

-

Send money to registered/enrolled Aani Participants instantly.

Request money from registered Aani Participants with the money will be credited to the account of the sender of the request upon the acceptance of the receiver of the request.

Split bills:

Requesting payment by Aani Participants - Send a collective split bill request (between 2 and 20 registered Aani Participants) to your family and friends, or

Generate a QR code for your family or friends (Aani Participants) to scan using their mobile in-person to make the payment.

Track and manage transactions and payment requests.

- What Information do I need to provide to enroll for Aani?

-

You need to provide your default NBQ account along with your registered mobile number and email address.

- Can I send and receive money from and to anyone in the UAE?

-

You can send and receive money from and to your contacts and beneficiaries who are enrolled for Aani with their participating banks in the UAE.

- What are the required contact details?

-

All you need to enter is your contact’s UAE active mobile number.

- Why did I receive the error message “The number is not registered with Aani Instant Payments Platform. Please enter a different number”?

-

The reason for the error message is that the required contact/beneficiary needs to be enrolled through their bank for using Aani with updated mobile number.

- What is the limit for each transaction through Aani?

-

The current limit is AED 5,000/- per day,

- What is the default Account?

-

Means the account where the outgoing or incoming Aani Instant Payments will be debited or credited respectively. You can set or change your default bank account anytime by logging into Aani App or through “Manage Accounts” in NBQ Online / Mobile Banking.

- When will my email address be enrolled?

-

At the time of Aani enrollment, email address will be required as optional. Once you register your email address, confirmation of transfers will be sent to both your mobile and email address.

- Do I need to save contacts in particular format?

-

Yes, contacts need to be saved in the format of (+971) xxxxxxx.

- Where can I check all my transactions?

-

Under Aani Payments > All Aani transactions.

- What is the validity of a transaction request?

-

The validity of a request is 7 days.

- What happens to the transfers initiated on a weekend or holiday?

-

Aani transactions are processed 24/7, unless there is any downtime by participating banks or UAEIPP, both of which will be communicated through Aani notifications.

- Can I cancel or reject Aani transfer after confirmation?

-

Aani transfers cannot be cancelled or amended once processed since these are STP (straight through-process) transactions, which are sent instantly to the beneficiary’s bank.

- Is it required to add the beneficiary in the frequent beneficiary list before initiating Aani transfers?

-

Beneficiary’s addition is not required to initiate Aani transfers. The contacts who have enrolled on the Aani platform will be available to initiate any Aani transfers.

- What is the processing time for Aani transactions?

-

The transaction processing time is 10 seconds.

- How to register to Aani App?

-

Download and install Aani App on your mobile device.

Enter your registered mobile number with NBQ and then enter the OTP you receive via SMS.

Choose NBQ as your Bank.

The App will be directed to NBQ Banking Application.

Login with credentials and choose your default account number.

Optionally, you can register your registered email address with the NBQ.

Once enrolled, you can use Aani App to send and receive money.

Online Banking

Our reliable and secure online banking platform provides high level of banking convenience.

Mobile Banking

NBQ Mobile Banking application offers simple hassle free banking services which can be experienced from the comfort of your palm. NBQ mobile banking application is secure and gives you the ability to perform convenient Banking services anytime, anywhere.

NBQ Phone Banking

Just One Call Away

Wherever you are, at any time of the day, you can access your accounts with NBQ Phone Banking. Just Call +971 600 56 56 56.